How to Use ELMSelect to Find a Student Loan

ELMSelect is a loan comparison tool that many colleges utilize to present private and alternative loan options available to families. Using ELMSelect to research student loans can be a great tool. Not every school partners with ELMSelect to present loan options, but many do. You can access ELMSelect from a link on your school's website or go directly to elmselect.com and use the drop down menu to select the school you attend (if your school does not participate, you will not be able to find it in the drop-down options).

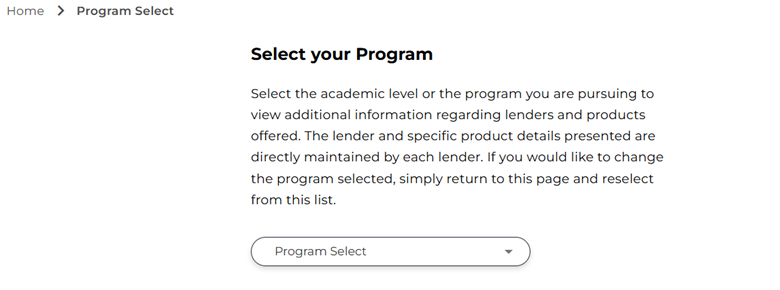

Once you've chosen your school, you will be asked what type of program you are pursuing to help match you with appropriate loan options. Choose your program from the drop-down list to see a list of lenders selected by the school for your program.

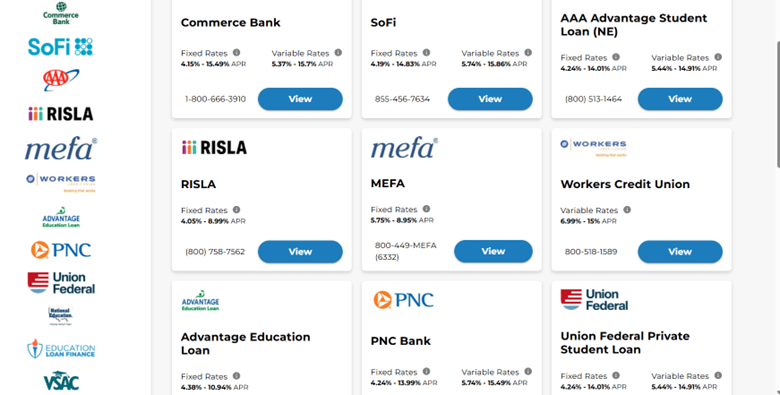

You are then presented with the list of loan options from lenders your school has selected. Your school may have chosen lenders for this list based on researching the best options for students or adding a list of lenders historically chosen by students at the school. It will likely not be an exhaustive list of all the options available to you, and you can choose to borrow with a lender not on the list if you find it to have more favorable terms for you.

This screen is a good place to compare the interest rates. Pay attention to the entire range of interest rates, not just the lowest rate listed. Most families end up with a loan somewhere in the mid-range of the interest rates. The lowest interest rates are often only available to borrowers with the very best credit. If you want to delve deeper into the details of each loan, you may click on the View button to be brought to the page for that specific lender.

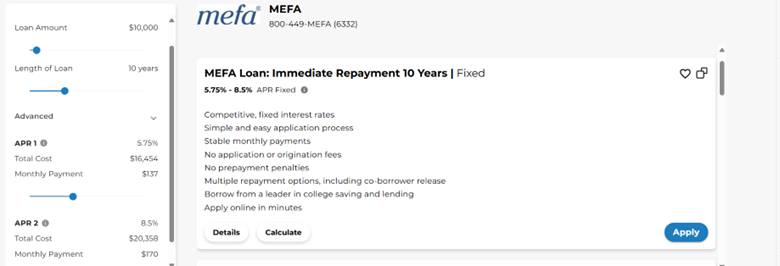

On the lender page, you can learn more about the loan and calculate the loan payment and total cost of the loan by clicking on Calculate. If you choose to calculate, you will be shown in the left-hand sidebar the monthly payment amount and total cost of the loan for the lowest and highest interest rates available based on the loan amount you select. Pay attention to the full range of costs and remember to keep in mind that most families do not qualify for the lowest interest rate.

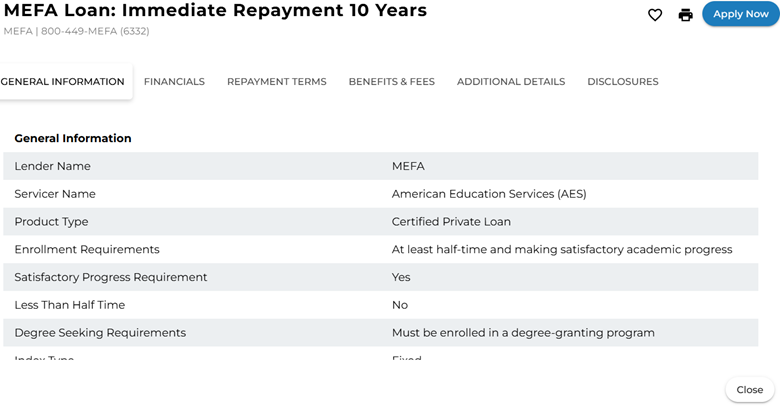

Also on the lender page you can select Details to see a lot more information about the loan, including degree and enrollment requirements, satisfactory academic progress requirements, fees, loan benefits, repayment terms, and disclosure statements.

Once you review the terms and details of a loan you can use the heart icon at the top of the page to add the loan to your favorites list if you think it is one you want to consider. You can also click the Apply Now button to be brought directly to the lender's website to apply for the loan.

You can access your list of favorites anytime and use this as a launching pad to apply for several and compare the actual interest rates you qualify for with each lender. Remember that you may apply to multiple student loan lenders within a 14-day period and it will only count as one inquiry to your credit report.

The process of choosing the best education loan can be daunting but ELMSelect may help you narrow down your best options. Each family is unique and this tool can help you find the best option based on your priorities and needs. However, remember, you are not limited to the options chosen by your school on ELMSelect. If you find a better option for your family elsewhere, go with that. ELMSelect is just one tool to help you as you make your plan to pay for college.