College Savings

Turning Tax Refunds into College Savings

Families who save for college are generally better equipped to navigate the college payment process, will not have their financial aid affected much by their savings, and will have to borrow less for college.

One of the most effective college savings strategies can be saving some or all of your tax refund in your child's college savings fund. We know that this isn't always an easy decision. Young families have a lot of financial needs. The thought of paying off a credit card balance, or getting that new furniture for the bedroom, or going on vacation, is admittedly more tempting than saving for college. But here's why it's still worth it:

- You'll make a dent in what you'll have to pay later on, especially if you deposit your entire tax refund, or a good portion of it. Though college is expensive, you probably won't have to save the entire cost thanks to financial aid. And since the financial aid formula counts a family's income more than their savings, the amount saved should have a minimal impact on financial aid.

- Saving for college will better equip you to navigate the college payment process when the time comes, in part because you'll be less anxious. Thinking through college costs now, and setting aside savings for them, will help lessen the shock when that college bill arrives.

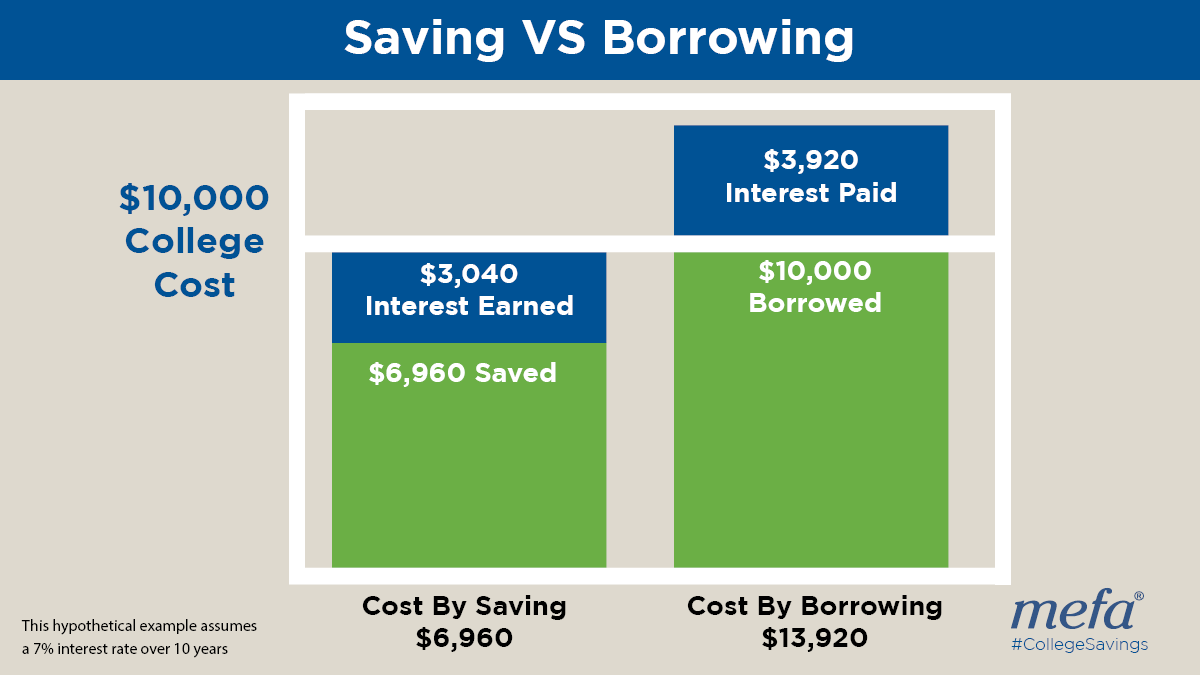

- Saving can reduce or eliminate the need to borrow. Many students and families find themselves in the position of graduating from school and having to pay a student loan bill every month that is just too much for them to afford. Saving now helps to avoid that. The graphic below shows that financing a $10,000 college cost looks very different for a family that has saved versus a family needing to borrow the entire sum. Remember, earning interest is better than paying interest.

- If your child knows that you are putting money away to pay for his or her college costs, he or she will be more likely to attend school. Studies have shown that those students who know money is being saved for them in a designated college savings account are much more likely to attend and graduate college—regardless of the amount saved. So even a little saving goes a long way.

- There's an easy and fast way to split your refund and have portions transferred directly to separate accounts: IRS Form 8888 allows you to list up to three separate accounts into which you would like your refund deposited, including your 529 account. Attach the form to your federal income tax return, either electronically or by hand.

Remember, saving for college is in an investment in your child's future. And what better way is there to spend your tax refund than that?

Sign Up for Emails

Sign up for relevant, helpful college planning emails.