What is an Education Loan Final Disclosure?

When you borrow an education loan to pay for college, your lender must provide a final disclosure once your loan is finalized. The statement includes pertinent loan details, including the amount you borrowed, your interest rate, any fees, and how much the loan will end up costing you in total.

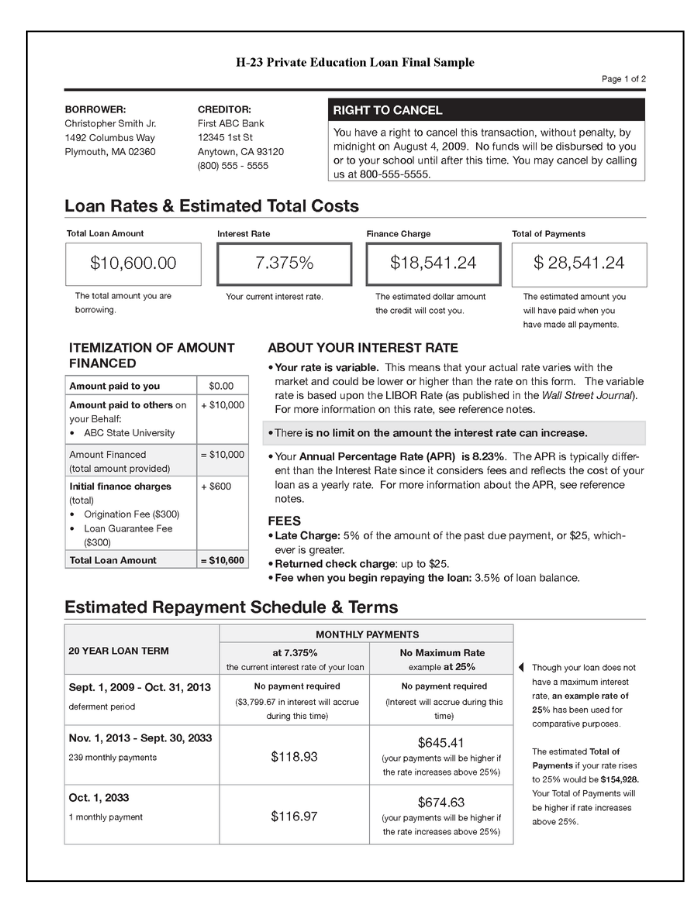

Below you'll find an example of a loan disclosure provided by the Federal Reserve with the following information.

Contact Information & Right to Cancel

The top section of your disclosure will list your name and address, your lender's name and address, and your right to cancel the loan before a certain date.

Loan Rates & Estimated Total Costs

The next section of the disclosure will show the amount you're borrowing, your interest rate, the finance charge (the extra amount you'll pay due to interest on the loan), and the estimated amount you'll pay in total for the loan. This section will also include a description of your interest rate type (fixed or variable), your Annual Percentage Rate (APR), which considers both your interest rate and fees, and a description of any fees you could or will incur.

Estimated Repayment Schedule & Terms

The last section of the disclosure will reveal your timeframe of payments due, based on your repayment type and current interest rate, and a hypothetical higher rate if your loan is variable.

The back page of the disclosure (not shown) lists any relevant notes, including those related to your interest rate, bankruptcy limitations, repayment options, and prepayments.

Why is this important to you?

When you receive your loan disclosure, you may be tempted to ignore it as trivial paperwork in the loan application process. But it's a key piece of documentation to help you understand the financial responsibility you just accepted, and how your loan will impact your future financial state.