What is the U.Plan?

The U.Plan is the Massachusetts prepaid college tuition plan that allows you to get a head start on paying for your child's college costs by locking in current rates on tuition and mandatory fees.

Safety and Peace of Mind

The U.Plan is one of the safest options to save for college. Your money is invested in bonds, which means it's not subject to market fluctuations. If your child doesn't attend a participating school, you get your money back with interest!

Many College Options

Over 70 colleges and universities in Massachusetts participate in the U.Plan, meaning you have plenty of options for your child's future education. And you don't have to choose a school until it's time for your child to go to college.

Flexible Savings

The U.Plan is flexible to meet your goals and budget. You can open an account with $0 and can easily set up monthly contributions. U.Plan contributions can qualify you for a state income tax deduction of up to $1,000 for single filers, and up to $2,000 for married persons filing jointly.

Who is Eligible?

Who is Eligible?

How the U.Plan Prepaid Tuition Plan Works

Future college tuition at today's rates

The U.Plan allows you to save for your child's future college tuition at today's rates, protecting you from rising tuition costs.

Begin contributing money right away

To get started with a prepaid tuition plan, you can enroll and begin contributing money right away. On July 15th each year, your contributions from the last 12 months will be used to purchase Tuition Certificates that cover a percentage of tuition and mandatory fees at participating colleges and universities in Massachusetts. You'll lock in that percentage, which means even if the cost of tuition increases, your Tuition Certificates will still cover the same percentage. Beginning August 4th of each year, you can begin contributing again to your U.Plan account for your Tuition Certificates to be purchased the following July 15th.

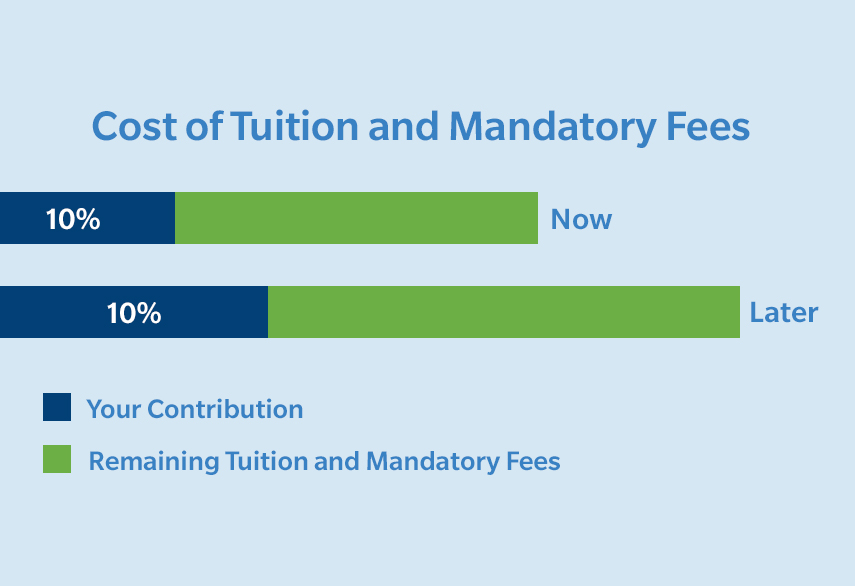

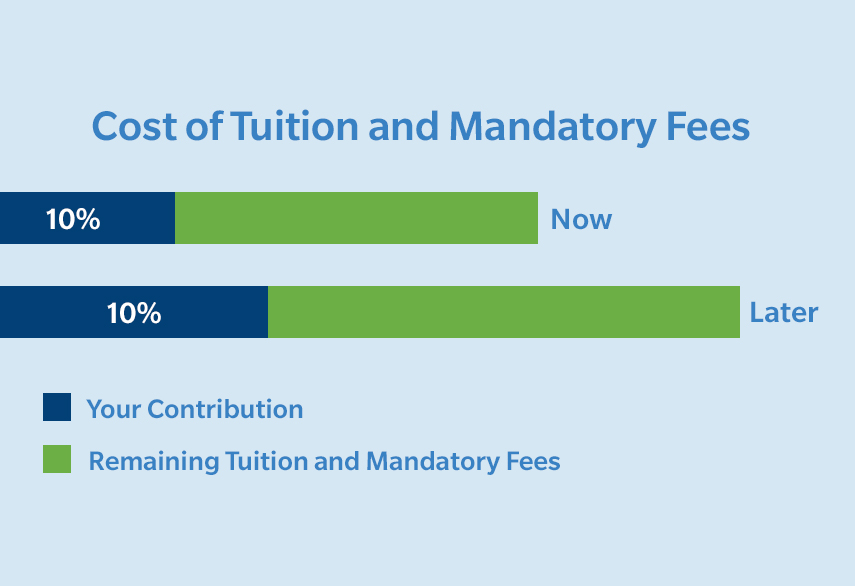

Example: Let's say you contribute $1,500 to your U.Plan to cover 10% of a year of mandatory fees and tuition now at a given school ($15,000). If the tuition and mandatory fees increase to $25,000 over the life of your U.Plan, that Tuition Certificate will still cover 10%, or $2,500, of tuition and mandatory fees at that school, meaning you saved $1,000. That's a 67% return on your investment!

Over 70 participating Massachusetts colleges and universities

With the U.Plan, you aren't required to choose a college ahead of time! Over 70 colleges and universities in Massachusetts participate in the U.Plan, meaning you have plenty of options for your child's future education. Want a more in-depth look at the U.Plan? Check out our webinar HERE.

Why U.Plan Prepaid Tuition Plan?

Safe prepaid college tuition

The U.Plan is one of the safest prepaid college tuition options to save for college. If your child doesn't attend a participating school, you get your money back with interest!*

Choose your child's college when they are ready

With the U.Plan, you don't have to choose a school until it's time for your child to go to college.

Tax Deduction

U.Plan contributions can qualify you for a state income tax deduction of up to $1,000 for single filers, and up to $2,000 for married persons filing jointly.

Flexibility

The U.Plan is flexible to meet your goals and budget. You can open an account with $0, and invest as little as $25 per month in order to save the $300 needed to purchase a Tuition Certificate each year and lock in a percentage of tuition and mandatory fee rates.

Parent Assets

Your U.Plan savings count as a parent asset in the financial aid formula, which assumes no more than 5.6% of parent assets can be used for college costs.

*Interest annually compounded according to the Consumer Price Index (CPI).

Who is eligible for the U.Plan Prepaid Tuition?

You can save for a child in a prepaid tuition plan from newborn up through 10th grade, and you don't have to be a Massachusetts resident to participate.

All prepaid tuition plan savers must be citizens or permanent residents of the United States.

Get Started

Online

Here's how to open your online U.Plan account:

- For existing U.Plan savers, click the Sign Up button below and select Existing U.Plan saver? Create an Online Account.

- If you are new to the U.Plan, click the Sign Up button below and select First-time U.Plan saver? Enroll Now.

By opening a U.Plan account online, you gain 24/7 access to your U.Plan information. You can also instantly add funds, set up automatic deposits, and request a disbursement.

Please note that you must use one of the following supported desktop browsers to create an online U.Plan account: Google Chrome – two latest versions; IE 11; Microsoft Edge; Safari for Mac – two latest versions (Safari for Windows is not supported).

Offline

To open your U.Plan account offline, download the enrollment application (Purchase Request Form) and view the supporting resources below.

After you start saving in the U.Plan, you will receive quarterly statements that will detail your contributions.

You may send your U.Plan funds to one of the plan's participating colleges and universities in Massachusetts to pay for tuition and mandatory fees, or you may request to receive the funds directly to pay for costs at a non-participating school. Follow these steps to request a distribution of your U.Plan funds:

- Log in to your account online.

- Select Redemption in the left-hand sidebar.

- Select the appropriate U.Plan account in the drop-down bar and indicate whether you need the funds sent to the institution or the account owner and then provide the requested information.

- On the next Order Review screen you'll be given the dates of when your funds will be sent.

- If you have questions, you can reach a U.Plan expert by calling (888) 590-5653.

- You can also watch an instructional video on making a distribution from your U.Plan account here.

Who is Eligible?

Who is Eligible?

How the U.Plan Prepaid Tuition Plan Works

Future college tuition at today's rates

The U.Plan allows you to save for your child's future college tuition at today's rates, protecting you from rising tuition costs.

Begin contributing money right away

To get started with a prepaid tuition plan, you can enroll and begin contributing money right away. On July 15th each year, your contributions from the last 12 months will be used to purchase Tuition Certificates that cover a percentage of tuition and mandatory fees at participating colleges and universities in Massachusetts. You'll lock in that percentage, which means even if the cost of tuition increases, your Tuition Certificates will still cover the same percentage. Beginning August 4th of each year, you can begin contributing again to your U.Plan account for your Tuition Certificates to be purchased the following July 15th.

Example: Let's say you contribute $1,500 to your U.Plan to cover 10% of a year of mandatory fees and tuition now at a given school ($15,000). If the tuition and mandatory fees increase to $25,000 over the life of your U.Plan, that Tuition Certificate will still cover 10%, or $2,500, of tuition and mandatory fees at that school, meaning you saved $1,000. That's a 67% return on your investment!

Over 70 participating Massachusetts colleges and universities

With the U.Plan, you aren't required to choose a college ahead of time! Over 70 colleges and universities in Massachusetts participate in the U.Plan, meaning you have plenty of options for your child's future education. Want a more in-depth look at the U.Plan? Check out our webinar HERE.

Why U.Plan Prepaid Tuition Plan?

Safe prepaid college tuition

The U.Plan is one of the safest prepaid college tuition options to save for college. If your child doesn't attend a participating school, you get your money back with interest!*

Choose your child's college when they are ready

With the U.Plan, you don't have to choose a school until it's time for your child to go to college.

Tax Deduction

U.Plan contributions can qualify you for a state income tax deduction of up to $1,000 for single filers, and up to $2,000 for married persons filing jointly.

Flexibility

The U.Plan is flexible to meet your goals and budget. You can open an account with $0, and invest as little as $25 per month in order to save the $300 needed to purchase a Tuition Certificate each year and lock in a percentage of tuition and mandatory fee rates.

Parent Assets

Your U.Plan savings count as a parent asset in the financial aid formula, which assumes no more than 5.6% of parent assets can be used for college costs.

*Interest annually compounded according to the Consumer Price Index (CPI).

Who is eligible for the U.Plan Prepaid Tuition?

You can save for a child in a prepaid tuition plan from newborn up through 10th grade, and you don't have to be a Massachusetts resident to participate.

All prepaid tuition plan savers must be citizens or permanent residents of the United States.

Get Started

Online

Here's how to open your online U.Plan account:

- For existing U.Plan savers, click the Sign Up button below and select Existing U.Plan saver? Create an Online Account.

- If you are new to the U.Plan, click the Sign Up button below and select First-time U.Plan saver? Enroll Now.

By opening a U.Plan account online, you gain 24/7 access to your U.Plan information. You can also instantly add funds, set up automatic deposits, and request a disbursement.

Please note that you must use one of the following supported desktop browsers to create an online U.Plan account: Google Chrome – two latest versions; IE 11; Microsoft Edge; Safari for Mac – two latest versions (Safari for Windows is not supported).

Offline

To open your U.Plan account offline, download the enrollment application (Purchase Request Form) and view the supporting resources below.

After you start saving in the U.Plan, you will receive quarterly statements that will detail your contributions.

You may send your U.Plan funds to one of the plan's participating colleges and universities in Massachusetts to pay for tuition and mandatory fees, or you may request to receive the funds directly to pay for costs at a non-participating school. Follow these steps to request a distribution of your U.Plan funds:

- Log in to your account online.

- Select Redemption in the left-hand sidebar.

- Select the appropriate U.Plan account in the drop-down bar and indicate whether you need the funds sent to the institution or the account owner and then provide the requested information.

- On the next Order Review screen you'll be given the dates of when your funds will be sent.

- If you have questions, you can reach a U.Plan expert by calling (888) 590-5653.

- You can also watch an instructional video on making a distribution from your U.Plan account here.

FAQs

Read our comparison here.

You can open an account and begin the process of saving with any amount, but the minimum to purchase a U.Plan Tuition Certificate is $300. If you have at least $300 in your account at the time of the bond purchase in mid-July, your contributions will be used to purchase Tuition Certificates and will lock in that percentage of tuition and fees at each participating Massachusetts college and university. If you do not have $300 in your account at the time of the bond purchase, then your funds will remain in your money market account and will not be used to purchase U.Plan certificates that year.

Yes, you can enroll in an automatic monthly deposit, or choose a different withdrawal schedule. This makes it easy to save in the U.Plan throughout the year.

A maturity year is the year you'll be permitted to redeem your Tuition Certificate(s) for tuition and fees. Your maturity year(s) should be one or more of the years in which you expect your child to attend college. Use our Maturity Year Selection Guide to determine the appropriate maturity years for your U.Plan savings.

Please reference our blog post, U.Plan Investment Strategies, for guidance on selecting the maturity years for your investment.

You would need to estimate that based on your child's current age or grade. There is a Maturity Year Selection Guide and embedded in the online account setup to help you estimate on mefa.org. But use your discretion as this is only an estimate. Your child's date of birth and local school enrollment guidelines may factor in as to when your child enters Kindergarten.

No, you are not required to choose a college ahead of time. With the U.Plan, you don't have to choose a school until it's time for your child to attend college.

If a student does not attend a participating college or university, you have three options:

- You can wait and see if the student's plans change. Certificates are valid for six years after the maturity year.

- You can transfer the role of Beneficiary to another student within the family.

- You can cash out the funds. The owner will receive the funds that were invested in the plan plus interest calculated at the Consumer Price Index (CPI). There are no federal or Massachusetts tax consequences associated with cash-outs, but if you live outside Massachusetts, please consult the laws of your state of residence.

Tuition Certificates are valid for six years after the maturity year. If your Tuition Certificate matures and your child has not yet started college, you can simply hold on to it and use it the following year. The certificate will retain its value from the previous year.

Since the U.Plan bonds don't become liquid until your chosen maturity year, accessing U.Plan money early is more difficult. We will work with customers to honor their request if possible but we cannot guarantee that customers can access their U.Plan funds before they mature.

The 1099-DIV from the U.Plan will be mailed out each year by January 31st, and will also be available to view at that time within your online account. The 1099-DIV reflects your earnings on any U.Plan savings invested in a money market mutual fund. MEFA will only mail a 1099-DIV if your earnings equal or exceed $10.

Over 70 public and private colleges and universities in Massachusetts participate in the U.Plan. At each of these schools, your savings will lock in a percentage (up to 100%!) of current tuition and mandatory fees. You can view the full list here.

A prepaid tuition plan is a college savings program that allows you to prepay up to 100% of tuition and mandatory fees at participating colleges and universities. This provides a safeguard against the increase in college tuition.

Prepaid tuition plans cover tuition and mandatory fees at participating colleges and universities.

A college savings plan is any type of savings plan that allows you to save for future college expenses by setting aside money today. Massachusetts offers two college savings plan options, both with tax advantages: the U.Fund 529 College Investing Plan and the U.Plan Prepaid Tuition Program. The U.Fund provides different investment options and can be used at practically any college or university in the country. The U.Plan allows you to lock in current rates on mandatory tuition and fees at over 70 colleges and universities in Massachusetts.

Prepaid tuition plans such as the U.Plan offer many benefits. Read our blog post, 5 Reasons Why Everyone Loves The U.Plan to learn more about benefits the U.Plan offers.

Unlike a 529 plan, a prepaid tuition plan cannot be used to cover food and housing, books, supplies, and equipment.

If interest calculated at CPI outpaces the rise of tuition, we will cash out the Tuition Certificate to the owner. The U.Plan will always pay the highest value of the Tuition Certificate to the school or owner.